In Denver's thriving business environment, bridge financing through construction loans is a game-changer for companies expanding through property acquisition and development. These short-term, flexible options provide crucial capital for entrepreneurs to navigate transitional periods without traditional long-term debt burdens. With competitive interest rates and accessible availability, Denver's vibrant scene empowers businesses to invest in strategic growth opportunities, turning plans into reality through renovation, new facilities, or major projects, ultimately capturing new markets.

“Bridge loans have emerged as a powerful tool for businesses seeking to fuel their growth, and Denver is no exception. In this dynamic city, where competition thrives, understanding access to capital is key for entrepreneurs aiming to expand. This article explores how construction loans specifically can propel your business forward in the competitive Denver landscape. Discover the benefits of these flexible financing options tailored for construction projects, and unlock the potential to elevate your company.”

- Understanding Bridge Loans for Business Growth in Denver

- How Construction Loans Can Fuel Your Business Expansion

Understanding Bridge Loans for Business Growth in Denver

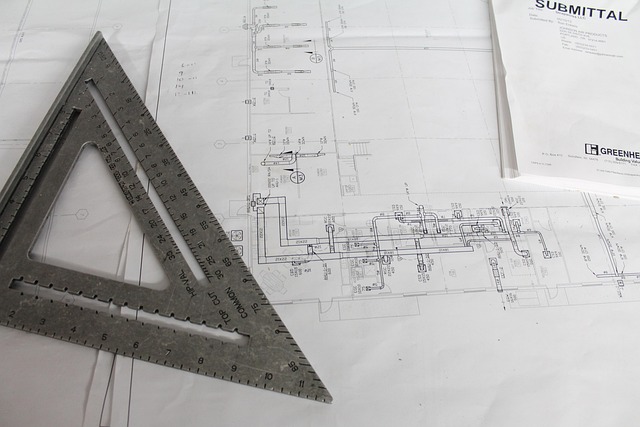

In Denver, bridge loans have emerged as a powerful tool for businesses aiming to expand and grow. These short-term financing solutions are specifically designed to fill the funding gap during a transition period, often between the acquisition of a new property and the long-term financing options becoming available. For businesses in construction or real estate development, a construction loan Denver can provide much-needed capital to kickstart projects without the burden of traditional long-term debt.

Denver’s vibrant business landscape presents unique opportunities for growth, but it also comes with challenges. Bridge loans offer a flexible and swift solution, allowing businesses to navigate these transitional phases efficiently. They are particularly beneficial for construction projects, as they can cover immediate expenses like materials, labor, and permits while the search for permanent financing continues. This strategic approach ensures that businesses in Denver can seize growth opportunities without being hindered by financial constraints.

How Construction Loans Can Fuel Your Business Expansion

In today’s competitive business landscape, expansion is key to staying ahead. For businesses aiming to grow, a construction loan in Denver can be a powerful tool. These loans provide the financial backbone needed to turn ambitious plans into reality, whether it’s constructing new facilities, renovating existing spaces, or funding major infrastructure projects. By securing a construction loan, businesses can access capital that facilitates their expansion, allowing them to scale operations and capture new markets.

Denver, known for its thriving business environment, offers accessible construction loans tailored to meet the diverse needs of enterprises. These loans often come with flexible terms and competitive interest rates, making them an attractive option for businesses looking to invest in their future. With a construction loan, companies can fund projects efficiently, ensuring smooth operations and sustained growth well into the future.

Bridge loans, particularly construction loans in Denver, offer a strategic solution for businesses seeking to expand. By providing access to capital for project funding, these loans facilitate growth and enable entrepreneurs to navigate the competitive landscape with confidence. When exploring construction loans in Denver, it’s essential to choose reputable lenders who understand the unique needs of local businesses, ensuring a seamless process that supports your company’s future success.