In Denver's dynamic real estate market, understanding diverse multifamily loan options is crucial for investors and developers aiming to capitalize on the booming population and economy. Professional guidance from experts in multifamily loans Denver enables informed decision-making, navigating complex processes, identifying high-potential areas, minimizing risks, and maximizing returns. Engaging specialist advisors provides deep knowledge of financing landscapes, access to tailored strategies, insights into market trends and regulatory changes, and streamlined loan processes, ensuring investors stay ahead in the competitive market.

In the vibrant real estate market of Denver, understanding multifamily loan options is crucial for investors aiming to thrive. This guide delves into the significance of expert guidance in navigating Denver’s complex multifamily lending landscape. From comprehending diverse loan types to mastering a step-by-step approach, this article equips investors with knowledge. We explore key benefits, success stories through professional support, and offer insights on building a top-tier team of loan experts for successful multifamily investments in Denver.

- Understanding Multifamily Loan Options in Denver

- Why Expert Guidance is Essential for Denver Real Estate Investors

- Navigating Complexities: A Step-by-Step Approach with Experts

- Key Benefits of Engaging Specialist Advisors in Denver's Market

- Case Studies: Successful Transactions Through Professional Support

- Building Your Team: Finding and Collaborating with Top Loan Experts

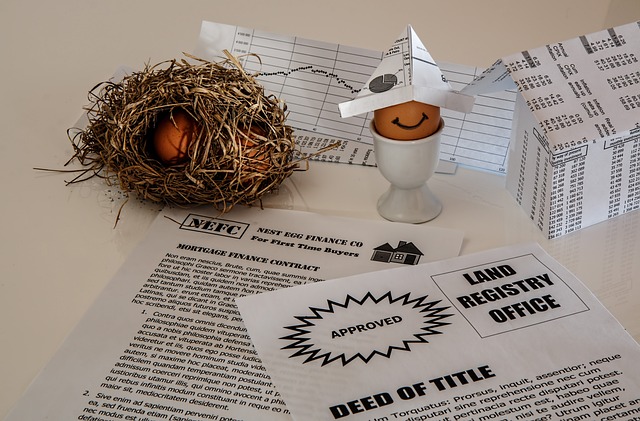

Understanding Multifamily Loan Options in Denver

In the vibrant real estate market of Denver, understanding your multifamily loan options is crucial for investors and developers seeking to navigate this bustling landscape. With a growing population and a thriving economy, Denver presents attractive opportunities for multifamily housing projects. Lenders offer various loan programs tailored specifically to multifamily properties in this region, catering to different investment strategies and project types.

When exploring multifamily loans in Denver, borrowers should consider options such as conventional loans, government-backed loans like FHA or USDA, and private bank financing. Each has its advantages, with government-backed loans often providing more flexible qualifying criteria and lower down payment requirements. Conventional loans, on the other hand, typically offer lower interest rates for borrowers with strong credit profiles. Understanding these nuances is key to finding the most suitable loan product for your multifamily investment goals in Denver.

Why Expert Guidance is Essential for Denver Real Estate Investors

In the competitive landscape of Denver real estate, expert guidance is indispensable for investors aiming to navigate the complex market successfully. With its booming economy and thriving property sector, Denver presents unique opportunities, but also challenges that require a deep understanding of local trends and regulations. Investors who venture into multifamily loan denver without professional assistance may miss out on lucrative deals or inadvertently stumble into legal pitfalls.

Expert guidance offers several key advantages. It provides investors with valuable insights into market dynamics, helping them identify high-potential areas for multifamily development. Additionally, professionals in this field can assist with navigating the intricate processes of securing loans, understanding zoning laws, and managing investment strategies. This support is crucial for making informed decisions, minimizing risks, and maximizing returns on Denver’s dynamic real estate market.

Navigating Complexities: A Step-by-Step Approach with Experts

Navigating the complexities of a multifamily loan in Denver requires a strategic approach, and that’s where expert guidance becomes invaluable. This is especially true for investors new to the market who may find themselves overwhelmed by the intricate processes and regulations surrounding multifamily real estate financing. A step-by-step process with experienced professionals can streamline this journey, ensuring a smoother transition.

Experts in Denver’s multifamily loan market understand the unique challenges and opportunities presented by the city’s vibrant real estate scene. They offer tailored strategies to guide investors through each phase, from initial property identification to final funding. By employing their extensive knowledge of local market trends, financing options, and regulatory requirements, they help clients make informed decisions, mitigate risks, and maximize returns on their investments, be it a multifamily apartment complex or mixed-use development.

Key Benefits of Engaging Specialist Advisors in Denver's Market

Engaging specialist advisors in Denver’s market for multifamily loans offers a multitude of key benefits. These experts possess deep knowledge and experience navigating the complex landscape of commercial real estate financing. By tapping into their expertise, investors can access tailored strategies that align with their specific goals, whether it’s acquiring new properties, refinancing existing ones, or securing capital for renovations. Their insights into market trends, regulatory changes, and lending criteria enable informed decision-making, minimizing risks and maximizing returns.

Specialist advisors play a pivotal role in streamlining the loan process. They guide clients through every step, from initial consultation to final approval, ensuring a smooth and efficient experience. By leveraging their relationships with lenders and investment banks, they can secure competitive terms and rates, ultimately saving investors time and money. This level of personalized service is invaluable, especially in Denver’s dynamic market where staying ahead of the curve demands constant expertise and adaptability.

Case Studies: Successful Transactions Through Professional Support

In the competitive landscape of Denver’s multifamily real estate market, access to expert guidance can be a game-changer. Numerous case studies highlight successful transactions where professional support played a pivotal role. For instance, a recent project involved a developer seeking funding for a substantial multifamily loan in Denver. With the help of seasoned industry experts, they navigated complex financial dynamics and secured a favorable loan with competitive terms, enabling them to proceed with their development plans unencumbered.

This success story is not an isolated incident. Many similar cases demonstrate how professional support can enhance deal flow, mitigate risks, and optimize outcomes. By leveraging their extensive knowledge of Denver’s multifamily market and its unique financing requirements, these experts have consistently facilitated successful transactions, fostering a thriving environment for both developers and investors.

Building Your Team: Finding and Collaborating with Top Loan Experts

Building a strong team is key to navigating the complex world of multifamily loan Denver. The right experts can provide invaluable insights and streamline the entire process, ensuring a seamless experience for both investors and lenders. When assembling your team, look for individuals with extensive knowledge in the multifamily lending sector, preferably with a proven track record in Denver’s real estate market.

Recruit professionals who excel in areas such as underwriting, risk assessment, and loan structuring. Collaborate closely with these experts to understand their unique perspectives and leverage their skills. Effective communication and open dialogue will foster a productive working environment, ultimately leading to better outcomes for multifamily loan projects in Denver.

When navigating the complex world of multifamily loan options in Denver, expert guidance is invaluable. By engaging specialized advisors, real estate investors can streamline their transactions, access competitive rates, and navigate the unique challenges of Denver’s dynamic market. The case studies presented highlight successful collaborations, demonstrating that with the right team, investing in multifamily properties becomes a seamless and profitable journey. For those serious about Denver’s vibrant real estate scene, building a relationship with top loan experts is a strategic move that can lead to substantial returns.