In Denver's fast-growing real estate market, understanding and streamlining multifamily loan applications is vital. Technological advancements have transformed the process, offering online application platforms that reduce paperwork, delays, and costs. This digital revolution benefits lenders and borrowers alike, unlocking smoother transactions and fostering development in Denver's dynamic multifamily sector. The result is a more efficient, accessible, and attractive environment for real estate investors, contributing to the city's growth as a hub for multifamily loan opportunities.

In the dynamic real estate market of Denver, understanding the intricacies of multifamily loan applications is key to unlocking growth opportunities. Traditional systems, while robust, often present challenges that hinder efficiency and increase friction in the lending process. This article explores these challenges and delves into the transformative power of a streamlined application system for multifamily loans in Denver. We uncover the benefits of this approach and guide you through implementing a seamless digital solution to enhance accessibility and speed in financing opportunities.

- Understanding Multifamily Loan Applications in Denver

- Challenges with Traditional Systems and Their Impact

- The Benefits of a Streamlined Application Process

- Implementing a Seamless Digital Solution for Denver's Multifamily Loans

Understanding Multifamily Loan Applications in Denver

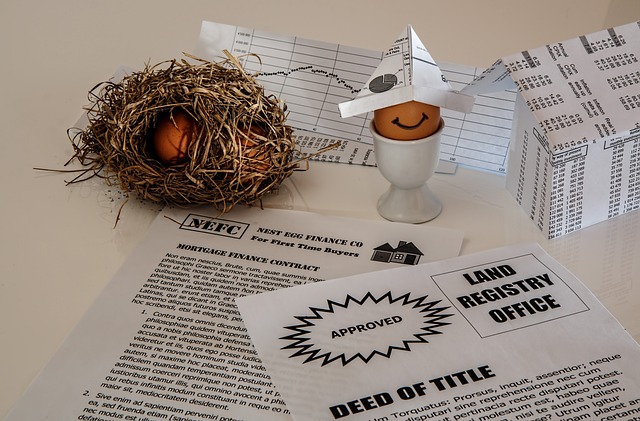

In the dynamic real estate market of Denver, understanding multifamily loan applications is paramount for both lenders and borrowers. Multifamily loans in Denver cater to a diverse range of properties, from apartment complexes to mixed-use developments, reflecting the city’s rapid growth and urban renewal. The streamlined application process for these loans has evolved significantly, driven by technological advancements and market demands.

This evolution has made applying for multifamily financing in Denver more efficient, transparent, and accessible. Lenders now employ robust digital platforms that enable borrowers to submit detailed applications online, complete with financial statements, property valuations, and business plans. This shift towards digitalization simplifies the evaluation process, allowing underwriters to assess applications swiftly while ensuring data accuracy and security.

Challenges with Traditional Systems and Their Impact

Traditional application processes for multifamily loans in Denver, and across the country, have long been known to be cumbersome and time-consuming. From piles of paperwork to lengthy approval times, these systems often present significant challenges for both lenders and borrowers. For multifamily investors and developers in Denver, navigating these complexities can delay projects, increase costs, and hinder access to capital, ultimately impacting their ability to grow and expand their portfolios.

In the dynamic real estate market, where speed is crucial, traditional systems struggle to keep up with demand. This is especially true in a city like Denver, known for its booming multifamily sector. Streamlined application processes are therefore not just desirable but essential to ensure lenders can efficiently manage high-volume applications and borrowers can secure financing promptly.

The Benefits of a Streamlined Application Process

A streamlined application process is a game-changer in the world of multifamily loan Denver. By simplifying and digitizing the traditional, often laborious application procedures, lenders can enhance efficiency while reducing costs. This modern approach ensures that both borrowers and lenders benefit from faster turnaround times, minimizing delays that could hinder development projects.

For multifamily real estate investments, a well-organized application system is key to unlocking smoother transactions. It allows for easier access to relevant data, enabling lenders to make informed decisions promptly. This efficiency not only benefits individual investors but also contributes to the overall growth and success of the Denver real estate market by expediting project funding and fostering development opportunities.

Implementing a Seamless Digital Solution for Denver's Multifamily Loans

In today’s digital era, streamlining processes is more crucial than ever for efficiency and customer satisfaction, especially in the complex realm of multifamily loan applications. Denver, a bustling metropolis, has recognized this need to enhance its lending landscape. By implementing a seamless digital solution for multifamily loans, the city aims to revolutionize the application process. This innovative approach promises to simplify procedures, making it faster and more accessible for developers and investors navigating the Denver market.

The new system is designed to offer a user-friendly interface, enabling applicants to submit their loan requests online with ease. Digital documentation and automated verification processes will significantly reduce paperwork and processing times, addressing the challenges faced by traditional lending methods. This streamlined approach not only benefits individual investors but also fosters growth in Denver’s multifamily sector, making it an attractive game-changer for those seeking investment opportunities in vibrant, developing communities.

The current landscape of multifamily loan applications in Denver, characterized by complex traditional systems, highlights the need for innovation. By adopting a streamlined application process, lenders can significantly enhance efficiency, reduce costs, and improve borrower experiences. Implementing a seamless digital solution tailored to Denver’s multifamily loan market is not just an option—it’s a necessity to stay competitive and support the city’s growing housing needs. This shift promises faster turnaround times, reduced paperwork, and more accessible financing options for developers and investors in the vibrant Denver multifamily sector.