In the competitive Colorado commercial property lending market, lenders offer flexible payment plans tailored to businesses' unique cash flow patterns and market dynamics. These plans include customizable schedules with variable interest rates, extended terms, and periodic principal paydowns, benefiting dynamic industries with fluctuating revenues and expenses. Such strategies strengthen lender-borrower relationships, solidify lenders' positions in the market, and attract a wider range of borrowers, expanding investment opportunities while mitigating risks.

In the competitive landscape of commercial property lending Colorado, tailored payment plans are emerging as a game-changer. This article explores how customized financing options, specifically designed to meet the unique needs of businesses in Colorado, offer substantial benefits. From enhancing cash flow management to fostering sustainable growth, these flexible plans revolutionize traditional lending models. We delve into the factors to consider when implementing such strategies, providing insights for both lenders and borrowers in the vibrant commercial real estate market of Colorado.

- Understanding Tailored Payment Plans in Commercial Property Lending Colorado

- Benefits and Considerations for Customized Financing Options

Understanding Tailored Payment Plans in Commercial Property Lending Colorado

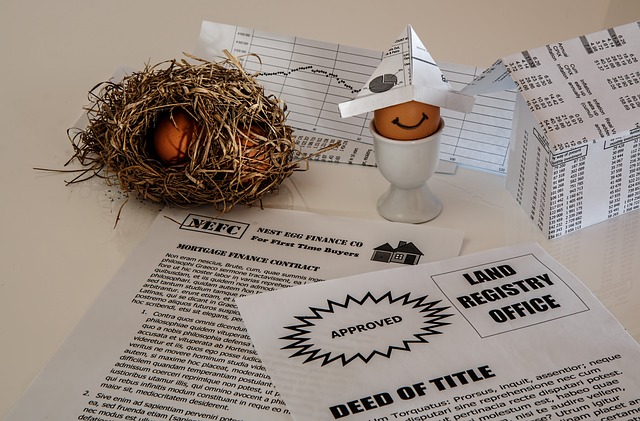

In the competitive landscape of commercial property lending Colorado, tailored payment plans are emerging as a strategic tool for lenders and borrowers alike. These flexible arrangements allow businesses to manage their financial obligations more effectively by aligning loan repayments with their cash flow patterns. By understanding their options and working closely with lenders, borrowers can structure payments that accommodate seasonal fluctuations, projected growth, or unexpected market shifts.

Tailored payment plans in commercial property lending Colorado involve customized schedules that go beyond the traditional fixed-rate mortgage. They may include variable interest rates, extended repayment terms, or periodic principal paydowns. Such flexibility is particularly beneficial for businesses operating in dynamic industries where revenue streams and expenses can vary significantly over time. Lenders who offer these tailored solutions not only enhance their competitive edge but also foster long-term relationships with borrowers by demonstrating a commitment to their success.

Benefits and Considerations for Customized Financing Options

Customized financing options, or tailored payment plans, offer significant advantages in the realm of commercial property lending Colorado. One of the key benefits is enhanced customer satisfaction and retention. By understanding each borrower’s unique financial situation, lenders can create plans that align with individual needs, making it more likely for tenants to stay put and successfully manage their properties. This stability benefits both parties over the long term, fostering a healthier rental market.

When considering tailored payment plans, lenders should weigh factors like tenant creditworthiness, property type, and local market trends. Offering flexible terms can attract a broader range of borrowers, increasing potential for investment opportunities in Colorado’s vibrant commercial real estate scene. However, careful assessment is crucial to mitigate risks associated with customized financing, ensuring both the lender and borrower emerge successful from the transaction.

Tailored payment plans, a key aspect of commercial property lending in Colorado, offer businesses flexible financing options. By understanding the benefits and considerations, lenders and borrowers can navigate the complexities of commercial real estate with greater ease. Customized financing allows for better alignment between loan terms and individual business needs, ultimately fostering growth and stability within Colorado’s vibrant commercial property market.