Bridge loans in Denver offer a specialized financial solution for complex real estate transactions, providing short-term funding to fill critical gaps. These loans enable buyers and sellers to navigate challenges, seize opportunities, or overcome temporary liquidity issues. Effective navigation requires strategic planning, market research, professional advice, and open communication with lenders. By understanding financial goals, exploring local Denver options, and comparing rates, individuals can secure competitive terms tailored to their unique situations, facilitating smoother transitions to permanent financing.

“In today’s dynamic market, navigating complex transactions can be a daunting task. This article illuminates the role of bridge loans in Denver, offering a strategic solution for real estate investors and individuals facing financial challenges. We’ll delve into understanding these intricate deals, exploring strategies to overcome common obstacles, and uncovering the benefits and best practices associated with bridge loans in the vibrant Denver landscape. By the end, readers will be equipped with insights to optimize their experiences.”

- Understanding Complex Transactions: The Bridge Loan in Denver

- Navigating the Challenges: Strategies for Seamless Process

- Benefits and Best Practices: Optimizing Your Experience with Bridge Loans in Denver

Understanding Complex Transactions: The Bridge Loan in Denver

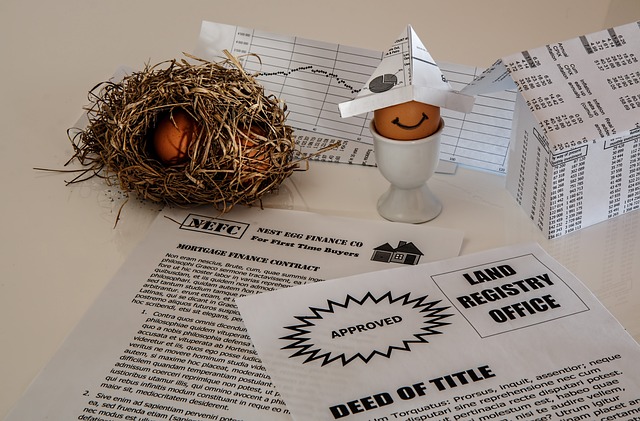

In the world of real estate, complex transactions often require specialized financial tools to ensure a smooth process. One such innovative solution is the bridge loan Denver, designed to fill temporary funding gaps and facilitate seamless property acquisitions or refinancings. These short-term loans provide a bridge between traditional financing options, making it easier for both buyers and sellers to navigate challenging situations.

When considering a bridge loan in Denver, understanding the transaction’s intricacies is key. This financial instrument offers flexibility by providing immediate access to capital, allowing individuals to seize opportunities or overcome temporary liquidity issues. It serves as a temporary fix, enabling borrowers to later obtain permanent financing or repay the bridge loan with reduced stress and improved terms.

Navigating the Challenges: Strategies for Seamless Process

Navigating complex transactions, such as securing a bridge loan Denver residents might need, can be daunting. Challenges arise from understanding intricate financial details, legalities, and ensuring a smooth process without delays. However, with strategic planning, these hurdles become manageable. One key strategy is comprehensive research; borrowers should study the market for reputable lenders offering bridge loans in Denver to find one suited to their needs.

Additionally, seeking professional advice from experienced financial consultants or attorneys specializing in real estate transactions can provide valuable insights and guidance. Maintaining open communication with the lender throughout the process ensures any issues are addressed promptly. This includes providing necessary documents accurately and timely, as required by the Denver bridge loan provider.

Benefits and Best Practices: Optimizing Your Experience with Bridge Loans in Denver

Bridge loans in Denver offer a range of benefits for those navigating complex transactions, especially in a dynamic market like Denver’s. These short-term financing options bridge the gap between traditional loans and immediate cash needs, providing flexibility and accessibility. One of the key advantages is their speed; bridge loans can be approved and disbursed swiftly, enabling individuals and businesses to seize opportunities or overcome temporary financial hurdles quickly. This is particularly valuable in a fast-paced city like Denver, where real estate transactions and business ventures often demand prompt decisions.

When utilizing bridge loans in Denver, adhering to best practices ensures an optimal experience. Lenders typically offer customized solutions based on individual needs, so it’s crucial to have a clear understanding of your financial goals and constraints. Transparent communication with lenders is essential, ensuring you grasp the loan terms, interest rates, and repayment conditions. Additionally, exploring local options and comparing rates from reputable Denver-based lenders can help secure competitive terms tailored to your specific situation.

Bridge loans in Denver can streamline complex transactions, offering a strategic solution for both borrowers and lenders. By understanding the intricacies of these loans and implementing best practices, individuals and businesses can navigate challenges effectively. This article has provided valuable insights into the benefits and key considerations when utilizing bridge loans, ensuring a more seamless and rewarding experience in the competitive Denver market.