Colorado's specialized industrial property lending sector thrives due to a diverse network of lenders, offering tailored financial solutions for businesses in manufacturing and logistics. This dynamic market facilitates economic growth by providing competitive funding options, flexible terms, and individual project assessments. With a surge in demand driven by e-commerce and a robust local economy, Colorado offers reliable access to capital for industrial property ventures, attracting both local and multinational companies. Entrepreneurs and investors can capitalize on this robust network, ensuring smoother journeys in acquiring or developing industrial real estate.

“Unleash the Potential of Industrial Property Lending in Colorado. This comprehensive guide explores the intricate world of industrial real estate financing, highlighting the significance of a robust network of lenders. Discover how diverse lending pools cater to Colorado’s unique market demands, ensuring accessible capital for businesses. Learn the art of assessing lender reliability and gain insights into leveraging local industry experts for sustainable growth. By understanding these dynamics, investors can navigate the landscape with confidence, unlocking lucrative opportunities in industrial property lending across the state.”

- Understanding Industrial Property Lending in Colorado

- The Role of a Strong Lender Network

- Benefits of a Diverse Lending Pool

- How to Evaluate Lender Reliability and Expertise

- Growing Your Business with Coloradan Industry Experts

Understanding Industrial Property Lending in Colorado

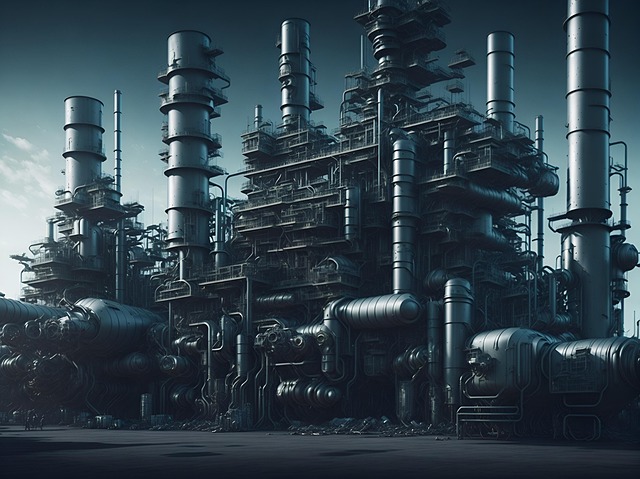

In Colorado, industrial property lending is a specialized sector that plays a critical role in supporting the state’s dynamic manufacturing and logistics industries. This type of lending focuses on providing financial solutions to businesses acquiring or developing industrial real estate, including factories, warehouses, and distribution centers. The market is characterized by a strong network of lenders, both traditional banks and alternative financing sources, who recognize the strategic value of these properties in supporting local economies.

Colorado’s robust industrial property lending landscape offers businesses diverse options for securing funding. Lenders assess each project individually, considering factors such as location, proximity to transportation hubs, and potential for economic impact. This tailored approach ensures that both established companies seeking expansion and startups requiring initial capital can access the financing they need. Furthermore, the state’s thriving economy and growing industrial sector create a favorable environment for lenders, leading to competitive interest rates and flexible terms, ultimately fostering business growth and innovation within the industrial property market in Colorado.

The Role of a Strong Lender Network

A strong network of lenders plays a pivotal role in shaping the landscape of industrial property lending in Colorado. This interconnected web of financial institutions, including banks, credit unions, and specialty lenders, offers a diverse range of financing options tailored to meet the unique needs of businesses seeking to acquire or develop industrial properties. The benefits are multifaceted: increased competition drives down interest rates, expands access to capital, and provides borrowers with more flexible terms and conditions.

In Colorado’s competitive real estate market, where demand for industrial spaces continues to surge due to e-commerce growth and a robust manufacturing sector, a robust lender network is indispensable. It ensures a steady pipeline of funding, facilitating the construction of new facilities, renovations, or expansions. This stability is crucial for business owners looking to capitalize on opportunities in the state’s thriving industrial sector, fostering economic growth and attracting both local and multinational companies.

Benefits of a Diverse Lending Pool

A diverse network of lenders in Colorado’s industrial property lending sector brings a multitude of benefits that enhance both the lending process and the market as a whole. By including various types of lenders, such as traditional banks, credit unions, and alternative financing providers, borrowers have access to a wider range of loan options tailored to their unique needs. This diversity fosters competition, leading to more competitive interest rates, flexible terms, and innovative financing structures for industrial property investments in Colorado.

Furthermore, a diverse lending pool encourages risk mitigation and stability. Different lenders may have varying risk appetites, investment strategies, and criteria for assessing borrowers, ensuring that even if one lender becomes cautious or tightens its policies, others can step in to maintain a consistent flow of credit. This diversity is particularly advantageous for the industrial property market, which often involves complex transactions with long-term implications. It allows for a more resilient financial ecosystem, supporting economic growth and providing borrowers with reliable access to capital for their Colorado industrial property ventures.

How to Evaluate Lender Reliability and Expertise

When evaluating a lender for industrial property lending in Colorado, it’s crucial to assess their reliability and expertise to ensure a smooth and successful transaction. Start by checking their reputation and track record; look for reviews from previous clients, especially those in the industrial sector, to gauge their performance and customer satisfaction. Reputable lenders will have an established history of managing complex industrial property transactions effectively.

Next, consider the lender’s expertise specifically tailored to industrial property lending. This includes their knowledge of local markets, current trends in industrial real estate, and the unique financing options available for such properties. Lenders who specialize in this area are more likely to offer tailored solutions that meet your specific needs. Ask about their loan products, interest rates, and terms, ensuring they align with your project’s requirements.

Growing Your Business with Coloradan Industry Experts

In the competitive world of business expansion, having access to a strong network of lenders can be a game-changer, especially within the niche market of industrial property lending in Colorado. This vibrant state has become a hub for diverse industries, attracting entrepreneurs and businesses seeking growth opportunities. By tapping into the expertise of local industry specialists, aspiring business owners can navigate the complex landscape of financing with confidence.

Colorado’s thriving economy offers a unique advantage for those looking to invest in industrial properties. Local lenders who specialize in this sector understand the specific needs of businesses related to manufacturing, logistics, and distribution centers. They provide tailored financial solutions, enabling entrepreneurs to secure funding for purchasing or renovating industrial spaces, thereby fostering economic growth across various sectors within the state.

Colorado’s thriving industrial sector benefits immensely from a robust network of lenders, facilitating access to capital for businesses. This interconnected ecosystem enables seamless transactions, fosters economic growth, and supports the state’s diverse industrial landscape. By leveraging a wide range of lending options and experts, entrepreneurs can navigate the complexities of industrial property lending with confidence, propelling their ventures forward in the competitive Colorado market.