Colorado's thriving real estate market, particularly in industrial property lending, offers tailored financing for warehouses, manufacturing facilities, and distribution centers. Key factors like location trends, borrower financial health, and loan purpose guide decision-making in this competitive market. Securing funding requires strategizing financial needs, assessing creditworthiness, researching specialized lenders, and preparing essential documents to negotiate favorable terms for industrial property acquisition.

“Unleash your industrial real estate dreams in Colorado with a comprehensive guide to financing. This article delves into the intricate world of industrial property lending, offering insights that cater specifically to Colorado’s dynamic market. From understanding key factors influencing financing decisions to navigating the process step-by-step, you’ll discover how to secure funding for your industrial properties effectively. Uncover the secrets to success in industrial property lending and take charge of your investment journey.”

- Understanding Industrial Property Lending in Colorado

- Key Factors Influencing Real Estate Financing Decisions

- Navigating the Process: Steps to Secure Financing for Your Industrial Property

Understanding Industrial Property Lending in Colorado

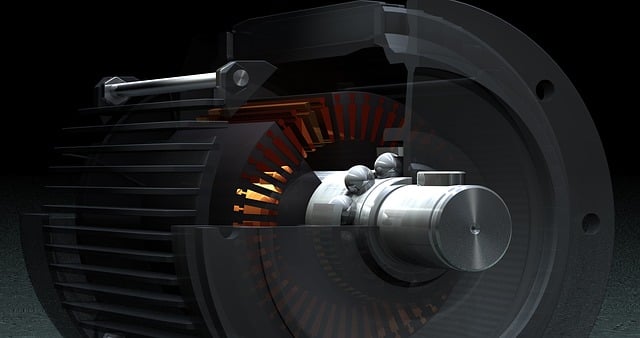

In the vibrant landscape of Colorado’s real estate market, industrial property lending plays a crucial role in fostering economic growth and supporting businesses. This specialized financing sector caters to the unique needs of commercial properties, such as warehouses, manufacturing facilities, and distribution centers. Lenders in Colorado have tailored their offerings to align with the state’s thriving industrial sector, providing essential capital for expansion, renovations, or new constructions.

Colorado’s industrial property lending market is characterized by a range of options, from traditional banks to alternative lenders. These institutions offer various loan products, including fixed-rate mortgages, adjustable-rate loans, and bridge financing, catering to different business stages and requirements. The state’s robust economy and favorable business environment make it an attractive destination for investors, driving the demand for industrial property lending and fostering a competitive yet dynamic market.

Key Factors Influencing Real Estate Financing Decisions

When it comes to real estate financing in Colorado, especially for industrial property lending, several key factors significantly influence decision-making processes. One of the primary considerations is the location and market trends of the property. The real estate landscape in Colorado varies across regions, with some areas experiencing higher demand and better rental yields than others. Lenders assess local economic health, population growth, and industry dynamics to gauge investment potential. For instance, industrial properties in close proximity to transportation hubs or major tech corridors might attract more attention due to the high demand for warehouse and distribution spaces.

Another crucial factor is the financial health of the borrower. Lenders carefully evaluate the creditworthiness of individuals or businesses seeking industrial property lending. This includes examining their income, debt obligations, and overall financial stability. A solid borrowing history and robust financial reserves can significantly improve the chances of securing favorable loan terms. Additionally, lenders may consider the purpose of the financing, whether it’s acquisition, construction, or refinancing, and tailor their offerings accordingly. In the competitive Colorado market, understanding these factors is essential for both borrowers and lenders to make informed decisions in industrial property lending.

Navigating the Process: Steps to Secure Financing for Your Industrial Property

Navigating the process of securing financing for your industrial property in Colorado involves several key steps. Firstly, define your financial needs and goals, including the purchase price and any renovation or expansion plans. Next, assess your creditworthiness by reviewing your personal and business credit scores, as well as your financial history. This step is crucial as it determines the interest rates and loan terms you’ll qualify for.

Once prepared, start shopping around for lenders who specialize in industrial property lending in Colorado. Look for institutions with a proven track record of financing similar properties and competitive rates. Gather and organize essential documents, such as tax returns, financial statements, and business plans, to present to potential lenders. This process will help you secure the best possible financing terms for your industrial property.

Industrial property lending in Colorado is a complex yet accessible process, with various factors influencing financing decisions. By understanding these key elements and navigating the steps to secure funding, investors can unlock opportunities in the vibrant Colorado real estate market. Industrial property lending plays a crucial role in fostering economic growth and innovation within the state, making it an essential aspect for both developers and business owners to consider when pursuing their industrial projects.