Securing a bridge loan in Denver, a complex real estate market, demands expert guidance due to intricate details and stringent requirements. Professional assistance offers insights into market trends, streamlined applications, strategic advice, and risk minimization, ensuring successful outcomes with favorable terms. Recent closings showcase the execution of intricate financial structures, highlighting adaptability and local synergy between institutions and developers, which drive urban development and innovative financing centered around bridge loans in Denver. Strategic planning is crucial for individuals and businesses seeking short-term funding, focusing on financial health assessment, repayment capabilities, and a clear fund utilization plan to navigate the Denver bridge loan landscape successfully.

In today’s dynamic financial landscape, complex transactions demand specialized assistance. Bridge loans have emerged as a vital tool, particularly in markets like Denver’s real estate sector. This article delves into the intricacies of understanding complex transactions, highlighting the crucial role of bridge loans in facilitating smoother deals. We explore benefits and challenges, present successful case studies, and offer practical tips for individuals and businesses looking to secure bridge loans effectively in Denver.

- Understanding Complex Transactions: A Glimpse into the Financial World

- The Role of Bridge Loans in Denver's Real Estate Market

- Unraveling the Process: How Bridge Loan Denver Facilitates Deals

- Benefits and Challenges: Navigating the Complexities with Experts

- Case Studies: Successful Complex Transaction Examples in Denver

- Tips for Individuals and Businesses: Securing a Bridge Loan Effectively

Understanding Complex Transactions: A Glimpse into the Financial World

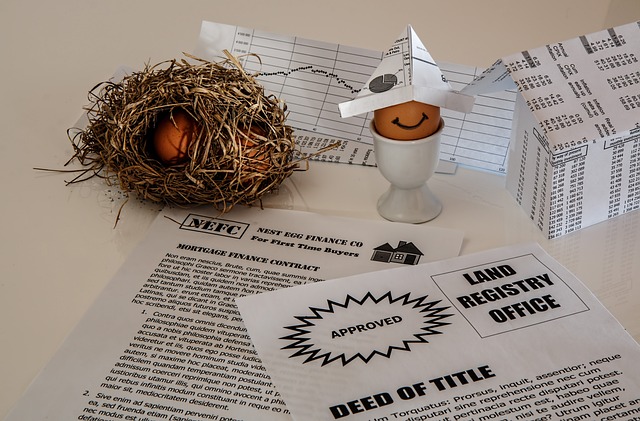

In today’s intricate financial landscape, understanding complex transactions is crucial for navigating the world of business and investment. Bridge loans, a specific instrument in Denver and beyond, exemplify this. These short-term financing solutions are designed to fill gaps between traditional loan options, providing businesses with the necessary capital during transitional periods. Whether it’s facilitating a merger, purchasing equipment, or managing cash flow, bridge loans offer flexibility and speed.

Delving deeper, complex transactions often involve unique structures and terms that differ from conventional loans. They may include secured or unsecured arrangements, varying interest rates, and repayment conditions tailored to the borrower’s needs. In Denver, where the real estate market is dynamic, bridge loans are frequently utilized for property acquisitions or refinancings, allowing investors to capitalize on opportunities swiftly. Understanding these nuances equips individuals and businesses with the knowledge to make informed decisions regarding their financial future, especially when traditional banking options may not adequately address their immediate needs.

The Role of Bridge Loans in Denver's Real Estate Market

In Denver’s dynamic real estate market, where transactions can be complex due to competitive pricing and limited inventory, bridge loans play a pivotal role in facilitating smooth purchases for both homebuyers and investors. These short-term financing options are designed to cover immediate funding needs, allowing individuals to seize advantageous opportunities without lengthy waiting periods. A Bridge Loan Denver provides a safety net, enabling buyers to secure their dream properties quickly, especially in a fast-paced market where timing is critical.

By offering flexible terms and swift approval processes, bridge loans cater to the unique demands of Denver’s real estate landscape. They are particularly beneficial for cash buyers who want to make competitive offers without having to wait for traditional mortgage approvals. This financial tool bridges the gap between selling and purchasing, ensuring that deals can be concluded efficiently, which is crucial in a market characterized by high demand and rapid price appreciation.

Unraveling the Process: How Bridge Loan Denver Facilitates Deals

in,

Benefits and Challenges: Navigating the Complexities with Experts

Navigating complex transactions, such as securing a bridge loan Denver, presents a unique set of challenges. While these short-term financing solutions offer critical support for businesses in need of immediate capital, the process involves intricate details and stringent requirements. This is where experts shine; they serve as invaluable guides, bridging the gap between understanding the vast array of variables and ensuring successful completion.

By enlisting professional assistance, individuals and businesses can harness several benefits. Experts possess in-depth knowledge of market trends and regulatory frameworks, enabling them to secure favorable terms. They streamline the application process, saving time and effort, and offer strategic advice tailored to unique circumstances. Moreover, their expertise minimizes risks, helping clients avoid common pitfalls that could lead to financial setbacks.

Case Studies: Successful Complex Transaction Examples in Denver

In the dynamic real estate market of Denver, Colorado, successful execution of complex transactions is not just a rare feat but an art that requires meticulous planning and innovative solutions. Case in point: the recent closing of several bridge loan deals that facilitated the acquisition and redevelopment of historic properties downtown. These transactions involved intricate financial structures, including short-term financing options like bridge loans Denver, allowing developers to swiftly capitalize on opportunities and breathe new life into underutilized spaces.

By studying these examples, aspiring real estate professionals can gain valuable insights into navigating complex scenarios. For instance, the successful integration of bridge loans in Denver demonstrated the importance of adaptability; each project demanded a tailored approach due to unique property characteristics and market dynamics. Moreover, these cases highlight the synergy between local financial institutions and developers, fostering an environment conducive to innovative financing solutions and robust urban development.

Tips for Individuals and Businesses: Securing a Bridge Loan Effectively

When considering a bridge loan Denver, both individuals and businesses should approach the process with careful planning and strategic moves. A bridge loan is a short-term financing solution designed to help close the gap in funding between the sale of an existing property and the purchase of a new one. For businesses, this can be crucial during periods of rapid growth or expansion, while individuals may use it for unexpected expenses like home renovations.

To secure a bridge loan effectively, it’s essential to first assess your financial situation. This includes evaluating your credit score, debt-to-income ratio, and available collateral. Lenders in Denver will consider these factors when determining loan terms, interest rates, and the amount offered. Additionally, having a clear understanding of your repayment capabilities and a solid plan for utilizing the funds can significantly enhance your chances of obtaining favorable loan conditions.

Bridge loans, particularly in the vibrant Denver real estate market, offer a strategic solution for navigating complex transactions. By understanding these financial instruments and leveraging expert guidance, individuals and businesses can successfully overcome challenges and secure lucrative deals. As demonstrated through various case studies, bridge loans have been instrumental in fostering growth and facilitating smooth, efficient transactions. When considering a bridge loan in Denver, it’s essential to partner with reputable professionals who can guide you through the process, ensuring a successful outcome that aligns with your financial goals.