In Denver's competitive multifamily real estate market, understanding interest rates is vital for securing optimal financing. Lower rates, driven by economic factors like a robust housing market and monetary policies, save thousands over time, especially for long-term financing. By shopping around, comparing offers, and strategically timing financing needs based on credit score, loan amount, and property type, investors can maximize ROI in the vibrant Denver multifamily sector. Secure low-interest rates and flexible terms to enhance cash flow, reinvest in property upgrades, and protect against future rate increases. Compare lenders, consider pre-approval, and lock in rates early for competitive multifamily loan Denver options.

“Uncover the power of competitive interest rates in the vibrant Denver multifamily market. This comprehensive guide navigates the intricate factors shaping interest rate competitiveness, offering insights into its significant benefits for investors. From understanding local dynamics to implementing strategies for securing low rates, we empower Denver’s multifamily lenders and investors with knowledge. Discover how locking in competitive rates can revolutionize your loan journey and foster prosperous investments within this bustling landscape.”

- Understanding Competitive Interest Rates in Multifamily Loan Denver

- Factors Influencing Interest Rate Competitiveness

- Benefits of Secure Low-Interest Rates for Denver Multifamily Investors

- Strategies to Lock in Competitive Rates for Your Next Loan

Understanding Competitive Interest Rates in Multifamily Loan Denver

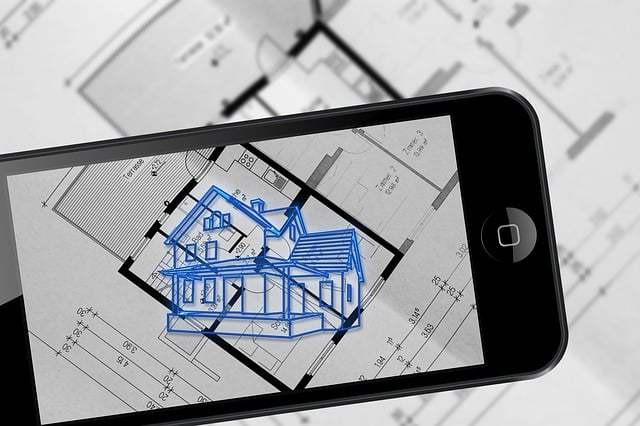

In the competitive market of Denver’s multifamily real estate, understanding interest rates is key to securing the best financing options for your project. Competitive interest rates refer to the lowest possible borrowing costs available for a particular loan type and borrower profile. For multifamily loans in Denver, these rates can significantly impact the financial health and return on investment (ROI) of your property. Lenders offer lower rates as an incentive to attract borrowers, making it essential to shop around and compare offers.

When evaluating multifamily loan denver options, consider factors like interest rate, term length, and any associated fees or discounts. A lower interest rate can save you thousands over the life of the loan, especially for long-term financing. Lenders often use factors such as credit score, loan amount, and property type to determine interest rates. Understanding these dynamics allows investors and developers to strategically time their financing needs and take advantage of market fluctuations, ultimately maximizing their investment potential in Denver’s vibrant multifamily sector.

Factors Influencing Interest Rate Competitiveness

In the competitive landscape of multifamily lending in Denver, several factors play a pivotal role in shaping interest rate competitiveness. One key aspect is the overall economic climate; Denver’s robust housing market and growing population often translate to lower interest rates as lenders compete to attract investors. Additionally, federal and local monetary policies significantly influence borrowing costs; for instance, changes in the federal funds rate can directly impact multifamily loan rates in Denver.

Specific to the Denver market, factors like supply and demand dynamics, property type preferences, and borrower creditworthiness also drive interest rate competitiveness. The city’s vibrant economy and high demand for quality multifamily housing keep rates competitive, especially for well-financed borrowers. Furthermore, the availability of government-backed loans and private financing options create a diverse range of interest rate choices for prospective lenders, ensuring that borrowers in Denver can find favorable terms tailored to their needs, whether they’re seeking traditional fixed-rate or adjustable-rate multifamily loans.

Benefits of Secure Low-Interest Rates for Denver Multifamily Investors

Secure low-interest rates offer a significant advantage for Denver multifamily investors looking to expand or stabilize their portfolios. With a multifamily loan Denver at competitive rates, investors can capitalize on the city’s thriving real estate market while minimizing financial risk. Lower interest payments mean more cash flow, enabling investors to reinvest in property upgrades, attract and retain tenants with lower rent costs, and achieve long-term financial goals.

This environment of low-interest rates also encourages multifamily loan Denver terms that are more flexible and adaptable to changing market conditions. Investors can lock in favorable rates for longer periods, protecting against potential future interest rate increases. This strategic move allows them to focus on operational efficiency and maximizing the value of their investments without the constant worry of rising debt costs.

Strategies to Lock in Competitive Rates for Your Next Loan

To secure competitive rates on your next multifamily loan in Denver, start by comparing lenders and their offerings well in advance. Research various financial institutions, including local banks, credit unions, and specialized mortgage companies, to find the best deals tailored to your project’s needs. Keep an eye out for promotions or special programs that could lower your interest rates.

Consider pre-approval for a loan before making any substantial plans. This process involves providing detailed financial information to lenders, allowing them to assess your eligibility and offer competitive rates. Additionally, locking in your rate as early as possible can protect you from potential market fluctuations, ensuring stability throughout your project’s lifecycle, especially in the dynamic multifamily real estate market of Denver.

Competitive interest rates play a pivotal role in shaping the financial landscape for Denver’s multifamily investors. By understanding the factors influencing these rates and adopting effective strategies, borrowers can secure low-interest loans, enhancing their investment returns. Navigating the market with insights gained from this article will enable multifamily loan denver seekers to make informed decisions, ensuring they maximize profits and stay ahead in a dynamic real estate sector.