Industrial property lending in Colorado thrives due to a collaborative network of lenders supporting manufacturing, warehousing, and logistics businesses. This dynamic sector offers flexible financing with competitive rates, guided by favorable economic conditions and market trends. Lenders pool diverse expertise for tailored solutions, ensuring access to capital for project expansion and secure operations. Choosing the right lender involves defining project needs, researching specialized industrial market experts, and evaluating transparency, rates, and reputation. Case studies highlight successful projects funded through collaborative lending, driving economic growth and positioning Colorado as a hub for industrial activity. Current trends include increasing demand for sustainable properties and technological advancements streamlining the lending process.

“Unleashing Growth Potential: Exploring Industrial Property Lending in Colorado

Colorado’s thriving industrial sector is fueled by a robust network of lenders, facilitating access to capital for businesses seeking expansion. This article delves into the intricacies of industrial property lending within the state, highlighting the pivotal role played by a strong lender community. We explore key benefits, from specialized financing options to tailored support, that contribute to Colorado’s economic prosperity. Additionally, we provide insights on selecting the ideal lender and offer case studies of successful industrial loans, offering valuable lessons for aspiring businesses.”

- Understanding Industrial Property Lending in Colorado

- The Role of a Strong Lender Network

- Key Benefits of a Robust Lending Community

- How to Choose the Right Lender for Your Project

- Case Studies: Successful Industrial Loans in Colorado

- Future Trends and the Evolving Landscape

Understanding Industrial Property Lending in Colorado

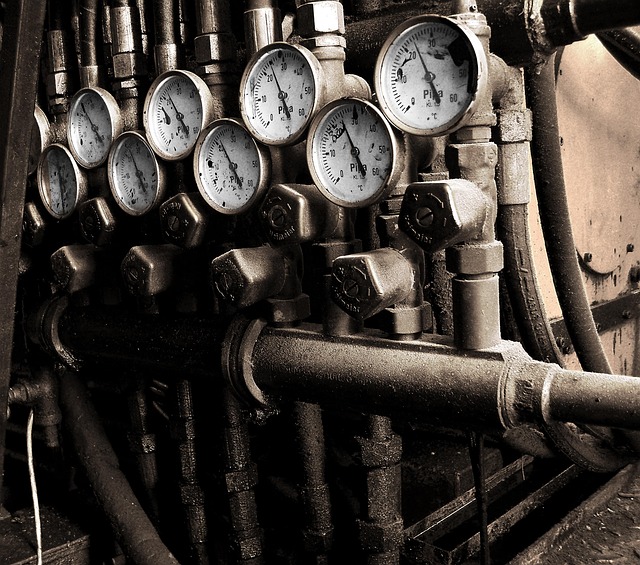

Industrial property lending in Colorado plays a pivotal role in shaping the state’s economic landscape. This specialized financing sector caters to businesses involved in manufacturing, warehousing, and logistics operations, offering tailored solutions to meet their unique needs. The market is characterized by a robust network of lenders, including banks, credit unions, and alternative financial service providers, all competing to offer competitive rates and flexible terms.

Colorado’s industrial property lending environment is driven by a combination of favorable economic conditions, such as strong demand for warehouse and distribution spaces, and the state’s thriving manufacturing sector. Lenders assess risk through comprehensive analysis of real estate values, business financials, and market trends, ensuring responsible lending practices while facilitating access to capital for businesses looking to expand or secure their operations in the state.

The Role of a Strong Lender Network

In the dynamic landscape of industrial property lending Colorado, a strong network of lenders plays a pivotal role in facilitating growth and innovation. These interconnected financial institutions bring diverse expertise and resources to the table, enabling borrowers to access tailored financing solutions for their commercial real estate ventures. By pooling their knowledge and capital, they mitigate risk, drive competition, and ultimately offer more favorable terms and conditions to potential investors.

The network effect amplifies the capabilities of individual lenders. They can collectively assess complex industrial property projects, leveraging each other’s strengths in areas like construction financing, land acquisition, or specialized lending programs. This collaborative approach ensures a robust pipeline of opportunities for borrowers seeking capital for their Colorado-based industrial properties, fostering a thriving and sustainable real estate market.

Key Benefits of a Robust Lending Community

A strong network of lenders is a cornerstone of any thriving real estate market, especially in the context of industrial property lending Colorado. This interconnected ecosystem offers numerous advantages that benefit both borrowers and lenders alike. One key advantage is increased access to capital, as a diverse range of lenders provides various financing options tailored to different borrower needs and risk profiles. This accessibility fosters competitiveness among lenders, often resulting in more favorable terms and rates for borrowers.

Additionally, a robust lending community promotes transparency and efficiency in the loan process. With multiple lenders competing for business, there is greater accountability and consistency in underwriting standards. Borrowers can expect smoother transactions, quicker approvals, and better service overall. This enhanced efficiency is particularly advantageous in the dynamic industrial property market where timely funding is crucial for project execution and economic growth.

How to Choose the Right Lender for Your Project

When seeking industrial property lending in Colorado, it’s crucial to choose a lender that aligns with your project’s unique needs. Start by clearly defining your project scope and financial goals. Research lenders who specialize in industrial property financing within the Colorado market, ensuring they have a proven track record of successfully funding similar projects. Look for lenders offering flexible terms, competitive interest rates, and transparent fee structures to suit your specific requirements.

Consider factors like lender reputation, customer reviews, and their understanding of local industry trends. Engage with several potential lenders, comparing their services, communication style, and overall responsiveness. The right lender will provide expert guidance tailored to your project, ensuring a smoother borrowing process and potentially unlocking opportunities for future growth in Colorado’s dynamic industrial property market.

Case Studies: Successful Industrial Loans in Colorado

In the competitive landscape of industrial property lending in Colorado, a strong network of lenders has proven to be a game-changer. Case studies highlight successful loans that have significantly contributed to the state’s economic growth and development. For instance, a prominent lender facilitated a $50 million financing package for a major manufacturing facility expansion project in Denver. This loan not only secured the future operations of the company but also created hundreds of construction jobs and stimulated local businesses.

Another notable case involves a collaborative effort between several lenders to provide a $20 million loan for the renovation and repurposing of an abandoned warehouse into a state-of-the-art logistics center. This project not only revived a neglected property but also attracted major e-commerce companies, further enhancing Colorado’s position as a hub for industrial activity. These success stories underscore the importance of a robust network in successfully executing complex industrial property lending initiatives in Colorado.

Future Trends and the Evolving Landscape

The landscape of industrial property lending in Colorado is constantly evolving, driven by emerging trends that shape the future of this sector. One notable trend is the increasing demand for sustainable and eco-friendly properties, reflecting a global shift towards greener practices. Lenders are responding by offering specialized financing options tailored to developers and owners investing in renewable energy projects, green buildings, and energy-efficient industrial facilities. This trend not only benefits the environment but also positions Colorado as a leader in sustainable development.

Technological advancements are another significant factor. Digital platforms and blockchain technology are streamlining the lending process, making it faster and more efficient. Lenders in Colorado are adopting these innovations to reduce paperwork, improve data security, and provide borrowers with real-time updates on their loan applications. Furthermore, the rise of alternative lenders and peer-to-peer financing platforms is introducing new dynamics into the market, providing borrowers with diverse funding options and potentially disrupting traditional lending models in industrial property financing.

Colorado’s thriving industrial landscape benefits immensely from a robust network of lenders, facilitating access to capital for businesses. This interconnected community plays a pivotal role in supporting local economic growth by offering specialized financing options tailored to the unique needs of industrial projects. By fostering competition and innovation, this strong lender network ensures that borrowers can secure favorable terms and conditions, ultimately fueling the success of industrial endeavors across the state. With continued collaboration and adaptation to evolving trends, Colorado’s industrial property lending sector is poised for further prosperity.