In Denver's competitive business environment, commercial loans from tailored lenders offer diverse financing options for various business needs. These customized loan packages provide flexible terms, supporting immediate goals and fostering long-term growth, ultimately enhancing financial health and market competitiveness.

In today’s dynamic business landscape, accessing tailored financial support is a game-changer. This article explores the world of commercial loans in Denver, highlighting how customized loan packages can propel local businesses forward. We delve into the art of understanding unique business needs and translating them into flexible financing solutions. Discover how these tailored strategies not only meet immediate capital requirements but also foster long-term growth in the competitive market of Denver’s commercial sector.

- Understanding Commercial Loans Denver Offers

- Tailoring Loan Packages to Business Needs

- The Benefits of Customized Financing Solutions

Understanding Commercial Loans Denver Offers

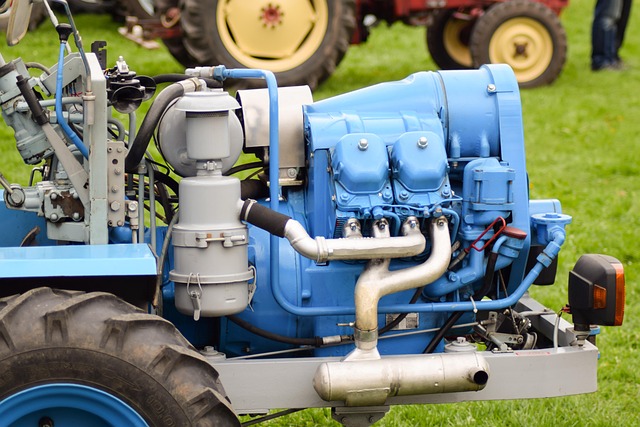

In the competitive business landscape of Denver, understanding tailored loan packages is paramount for entrepreneurial success. Commercial loans Denver offers vary widely to accommodate diverse needs, from small businesses seeking growth capital to large corporations expanding their operations. Lenders in Denver provide specialized financing options such as term loans, lines of credit, and equipment financing, each designed to support specific business objectives.

These commercial loans Denver market participants are known for their flexibility, allowing businesses to access the funds they need while maintaining manageable repayment terms. Whether it’s for purchasing equipment, funding working capital, or investing in real estate, understanding the available loan products and comparing rates from multiple lenders can significantly impact a company’s financial health and growth trajectory in the vibrant Denver market.

Tailoring Loan Packages to Business Needs

In the competitive business landscape, understanding that every company has unique needs is paramount. This is where tailored loan packages come into play, offering a strategic advantage to businesses in Denver and beyond. Commercial loans denver institutions excel at customizing financing options to align perfectly with specific business objectives. Whether it’s funding expansion plans, acquiring new equipment, or managing cash flow during seasonal fluctuations, these expert lenders provide solutions that go beyond standard offerings.

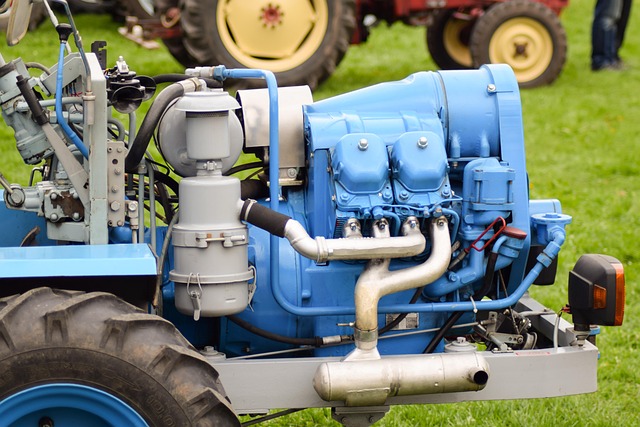

By evaluating each business’ financial health, industry trends, and future projections, lenders can structure loans that deliver both immediate support and long-term benefits. This personalized approach ensures businesses receive the most suitable terms, interest rates, and repayment conditions, fostering a collaborative partnership between borrower and lender.

The Benefits of Customized Financing Solutions

In today’s dynamic business landscape, tailored loan packages offer a competitive edge to companies in Denver. Commercial loans in Denver that are customized to meet specific needs provide numerous advantages. Firstly, they allow businesses to access flexible financing terms, ensuring they can adapt quickly to market fluctuations and seize growth opportunities. Unlike one-size-fits-all lending options, these packages consider unique operational requirements, risk profiles, and financial goals.

Additionally, tailored loan solutions promote long-term stability by aligning repayment schedules with cash flow patterns, reducing the strain on immediate liquidity. This level of customization also fosters trust between lenders and borrowers, leading to stronger partnerships. For businesses in Denver seeking commercial loans, a personalized approach can significantly impact their success and competitiveness in the market.

When it comes to propelling your business forward, tailored loan packages offer a competitive edge. Commercial loans Denver providers who specialize in this area understand that every business is unique, which is why they provide personalized financing solutions that align with individual needs. By carefully considering factors like revenue streams, growth plans, and industry trends, these lenders enable businesses to access the capital they need to thrive. Embrace customized financing and unlock the full potential of your Denver-based enterprise.