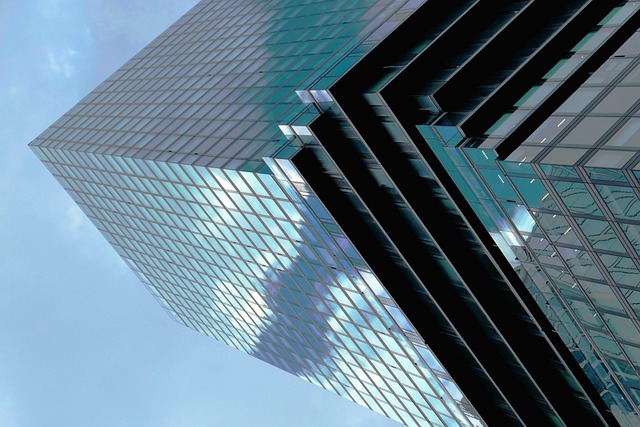

Investment property lending in Colorado thrives due to a robust real estate market, attracting various financial institutions offering diverse loan products for mixed-use development projects. These strategies, tailored to project stages and market gaps, facilitate sustainable urban growth by integrating residential, commercial, and retail spaces. Key examples include revitalized hubs like Denver's Union Station, showcasing the state's commitment to strategic financing practices that contribute to a diverse, prosperous economy while adhering to environmental stewardship and green building trends.

“Unveiling the Finansial Fabric: Mixed-Use Development and Investment Property Lending in Colorado

This comprehensive guide explores the intricate world of mixed-use development financing, focusing on Colorado’s dynamic market. We delve into the key players and types of investment property lending, dissecting factors that shape project viability. From navigating risks to showcasing success stories, this article offers insights for lenders and investors alike. Discover future trends redefining investment property lending in Colorado, ensuring a prosperous journey through this diverse real estate landscape.”

- Understanding Mixed-Use Development Financing in Colorado

- Investment Property Lending: Key Players and Types

- Factors Influencing Mixed-Use Project Financing

- Navigating Risks: A Lender's Perspective

- Success Stories: Case Studies from Colorado

- Future Trends Shaping Investment Property Lending

Understanding Mixed-Use Development Financing in Colorado

Mixed-use development financing in Colorado refers to a specialized type of investment property lending tailored to facilitate the creation and renewal of vibrant urban communities. This approach integrates residential, commercial, and sometimes retail spaces within a single project, fostering a dynamic environment that caters to diverse needs. In Colorado, where the real estate market is known for its robust growth and varied landscapes, understanding this financing model is crucial for developers, investors, and urban planners aiming to create sustainable and profitable mixed-use communities.

The state’s investment property lending ecosystem embraces innovative financial strategies to support these projects. Lenders in Colorado offer various loan programs designed to accommodate the unique requirements of mixed-use developments, including construction loans, permanent financing, and tax-efficient financing options. These products cater to different stages of development, ensuring that projects from conception to completion receive the necessary capital. By leveraging these financing mechanisms, developers can unlock opportunities to build mixed-use spaces that not only attract residents and businesses but also contribute to the economic vibrancy and cultural richness of local communities.

Investment Property Lending: Key Players and Types

Investment property lending in Colorado is a vibrant sector, attracting various financial institutions and investors due to the state’s robust real estate market. Key players include banks, credit unions, private lenders, and specialized mortgage companies, each offering distinct loan products tailored to investment properties. These range from conventional mortgages to more niche options like jumbo loans, construction financing, and bridge loans.

In Colorado, investment property lending is characterized by its diversity. Banks often cater to larger investors with stable financial histories, providing long-term, fixed-rate loans. Credit unions may offer competitive rates and flexible terms for members. Private lenders fill specific gaps in the market, catering to unique property types or those requiring faster funding. The variety ensures investors have options aligned with their investment strategies, making Colorado a hotspot for both residential and commercial investment property lending opportunities.

Factors Influencing Mixed-Use Project Financing

Mixed-use development projects in Colorado, like any other investment property lending endeavor, are influenced by a multitude of factors. One key aspect is market demand; strong demand for both residential and commercial spaces can boost project viability and attract investors. Location plays a pivotal role too; prime areas with easy access to amenities and transportation tend to offer better financing options due to increased property values and rental potential.

Regulations and zoning laws also significantly impact financing possibilities. Strict regulations might raise development costs, impacting profit margins and making it harder for lenders to secure favorable terms. Zoning restrictions can limit the mix of uses allowed, affecting project design and appeal to potential tenants and buyers. Additionally, economic conditions, such as interest rates and availability of capital, are crucial; favorable economic climates often lead to easier access to financing with competitive rates.

Navigating Risks: A Lender's Perspective

In the realm of mixed-use development financing, lenders play a pivotal role in bringing vibrant, bustling projects to life. When it comes to investment property lending in Colorado, navigators of risk must carefully assess each project. They scrutinize market trends, the developer’s track record, and the potential returns to mitigate risks associated with these complex developments.

Risk assessment is not just about identifying potential pitfalls; it’s also about recognizing opportunities. Lenders who understand the dynamic nature of mixed-use projects in Colorado can offer tailored financing solutions. By balancing prudence and vision, they foster a sustainable and prosperous real estate landscape, ensuring that investment property lending contributes to the state’s diverse and thriving economy.

Success Stories: Case Studies from Colorado

Colorado has emerged as a hotbed for successful mixed-use development projects, showcasing innovative financing strategies that have driven economic growth and revitalized urban areas. One notable example is the Transformation of Denver’s Union Station, where a public-private partnership secured substantial investment property lending Colorado to facilitate the project. The revitalized hub integrates residential, commercial, and entertainment spaces, attracting residents and tourists alike.

These case studies highlight the state’s commitment to fostering sustainable growth through diverse financing options. Lenders in Colorado have been instrumental in providing tailored solutions for mixed-use developments, addressing unique challenges with flexible terms and specialized knowledge in investment property lending. This approach has not only facilitated the creation of vibrant communities but also positioned Colorado as a model for successful mixed-use development across the nation.

Future Trends Shaping Investment Property Lending

The landscape of investment property lending in Colorado is evolving rapidly, driven by several future trends. One prominent shift is the increasing demand for mixed-use developments that seamlessly blend residential, commercial, and sometimes even recreational spaces. This integrated approach not only offers a more diverse range of options for residents but also presents unique financing opportunities. Lenders are increasingly recognizing the value of these projects in driving urban regeneration and diversifying real estate portfolios.

Moreover, the rise of sustainable and green building practices is reshaping investment property lending standards. Colorado, with its commitment to environmental stewardship, is at the forefront of this trend. Lenders are now incorporating green building certifications, energy-efficient design, and renewable energy sources into their assessment criteria. This shift not only aligns with broader market trends but also ensures that investment properties in Colorado remain competitive and attractive to environmentally conscious investors.

Mixed-use development financing in Colorado is a dynamic and multifaceted landscape, driven by diverse factors including market demand, regulatory environments, and innovative lending practices. Understanding the interplay of these elements, as highlighted through this exploration of investment property lending in Colorado, equips both developers and lenders to navigate risks and capitalize on opportunities. As the future trends evolve within investment property lending, Colorado continues to emerge as a hub for successful mixed-use projects, setting a benchmark for other regions to follow.