Asset-based lending in Colorado leverages diverse collaterals like real estate, equipment, inventory, intellectual property (including patents & trademarks), and even digital assets like blockchain technology. The state's robust economy and varied investment opportunities attract borrowers and investors. This lending sector plays a vital role in fueling local growth, with businesses utilizing their inventory and equipment as collateral. Colorado's progressive regulations also open doors for alternative investments like art, collectibles, and vintage items, offering unique financial and cultural benefits.

In the dynamic financial landscape of Colorado, asset-based lending has emerged as a flexible and innovative solution for businesses. This article delves into the diverse array of assets accepted by lenders, from traditional property and business equipment to intangible securities like patents and trademarks. We explore digital assets gaining recognition and alternative investments such as art and collectibles. Understanding these options is crucial for businesses seeking asset-based financing in Colorado, providing a comprehensive guide to navigating this dynamic market.

- Asset Types: Understanding Eligible Collateral

- Property and Real Estate Investment Opportunities

- Business Assets: Inventory to Equipment

- Intangibles: Patents, Trademarks, Copyrights Explored

- Digital Assets Gaining Recognition in Colorado

- Alternative Investments: Art, Collectibles, and More

Asset Types: Understanding Eligible Collateral

Asset-based lending in Colorado offers a unique opportunity for individuals and businesses to access capital by leveraging their assets. When it comes to understanding eligible collateral, various types of assets can be considered. This includes real estate properties, equipment, inventory, vehicles, and even intellectual property like patents and trademarks. Each asset class has its own set of requirements and criteria that lenders use to assess value and risk.

For instance, real estate is a popular choice for asset-based lending due to its tangible nature and consistent market value. Lenders will evaluate factors such as location, condition, and potential rental income. On the other hand, equipment and inventory may be preferred by businesses needing working capital, as they can quickly turn these assets into cash flow through sales or liquidation. Understanding which types of assets are accepted is crucial for borrowers looking to secure financing through asset-based lending in Colorado.

Property and Real Estate Investment Opportunities

Colorado offers a vibrant landscape for asset-based lending, with a diverse range of investment opportunities in property and real estate. The state’s robust economy and stable market conditions make it an attractive hub for both local and international investors seeking to diversify their portfolios. From bustling metropolitan areas like Denver to the serene mountain retreats, Colorado boasts a varied real estate market catering to different preferences and budgets.

Asset-based lending in this region provides investors with unique prospects, such as commercial property rentals, residential developments, and even land acquisitions. The state’s thriving tech sector, combined with its natural beauty, creates a diverse asset pool. Whether focusing on urban properties or rural lands, lenders and investors can explore lucrative avenues, ensuring long-term growth and returns in the dynamic Colorado market.

Business Assets: Inventory to Equipment

In the realm of asset-based lending in Colorado, businesses have a wide array of assets to leverage for financing. Among these, inventory and equipment stand out as cornerstone components, offering tangible security for loans. Inventory represents the goods or materials a business holds with the intent to sell, providing a dynamic snapshot of the company’s current financial health and market position. From raw materials to finished products, this asset class is especially valuable for businesses in manufacturing, retail, and distribution sectors, where cash flow fluctuations can be significant.

Equipment, on the other hand, encompasses machinery, vehicles, and technology integral to a business’s operations. This category includes everything from production lines and office machines to vehicles used in logistics and transportation. These assets are crucial for maintaining productivity and competitiveness, making them highly sought after by lenders in asset-based financing agreements. In Colorado, where businesses thrive in diverse industries, the ability to convert these tangible resources into capital can be a game-changer, facilitating growth and expansion while ensuring access to much-needed funds.

Intangibles: Patents, Trademarks, Copyrights Explored

In the realm of asset-based lending in Colorado, understanding the variety of assets accepted is key to unlocking financial opportunities. Beyond traditional tangible collateral like real estate and equipment, intangibles play a significant role. These non-physical assets, often referred to as intellectual property, include patents, trademarks, and copyrights—a diverse trio that can serve as compelling security for loans in Colorado’s dynamic business landscape.

Patents protect inventions, offering a powerful asset for entrepreneurs; trademarks safeguard brand identities, a vital consideration for many businesses; and copyrights shield creative works, from literature to music. Each of these intangibles contributes uniquely to a borrower’s financial profile, expanding the possibilities for asset-based lending in Colorado. This approach caters to the diverse needs of businesses operating in various sectors, fostering innovation and growth by providing access to capital leveraging their unique intellectual property assets.

Digital Assets Gaining Recognition in Colorado

In recent years, the concept of digital assets has been gaining significant traction, especially within the vibrant financial landscape of Colorado. With the state’s progressive approach to innovation and technology, asset-based lending in Colorado is evolving to include a diverse range of digital assets. This shift reflects a broader trend across the nation as folks embrace the potential of blockchain technology and cryptocurrency.

Colorado’s regulatory environment has been instrumental in fostering this growth, providing clear guidelines for digital asset acceptance while ensuring consumer protection. As a result, businesses are increasingly incorporating digital assets into their lending practices, opening up new opportunities for both lenders and borrowers. This development promises to revolutionize asset-based financing, making it more accessible and diverse in terms of what can be used as collateral.

Alternative Investments: Art, Collectibles, and More

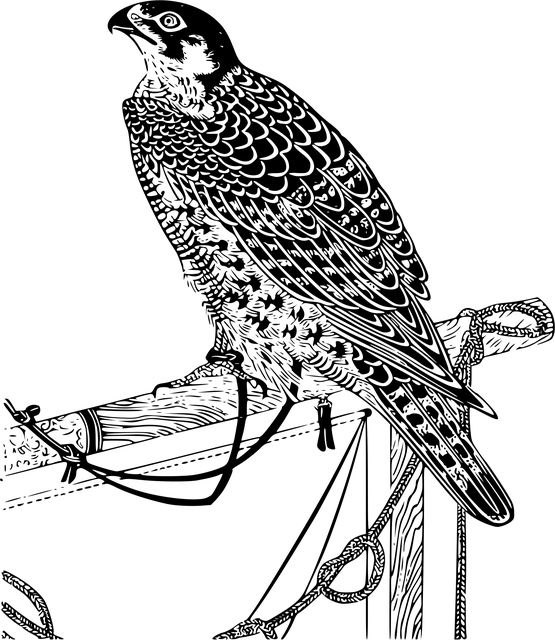

In the world of asset-based lending Colorado, investors are increasingly exploring diverse options beyond traditional stocks and bonds. Alternative investments, such as art, collectibles, and vintage items, have emerged as intriguing choices for those seeking to diversify their portfolios. These assets offer a unique opportunity to combine financial growth with a passion for culture and history. Art, in particular, has long been recognized as a valuable investment, with renowned pieces appreciating significantly over time.

When considering art as an investment vehicle, collectors often look beyond purely aesthetic appeal. Rare artworks, antique furnishings, or vintage artifacts can hold immense historical significance and cultural value. Such items are acquired not just for their current market price but also for their potential to increase in worth over the years, making them a reliable part of asset-based lending strategies in Colorado. This segment of the investment landscape is dynamic and requires expertise, but it presents an exciting avenue for investors aiming to branch out while reaping the rewards of their financial acumen.

In the realm of asset-based lending in Colorado, a diverse range of assets are now being recognized as eligible collateral. From traditional property and business assets to intangibles like patents and digital holdings, lenders are expanding their options. This evolution reflects the changing nature of investments, allowing for more opportunities in the competitive Colorado market. By embracing these varied asset types, both lenders and borrowers can navigate the financial landscape with enhanced flexibility and potential for growth in today’s digital era.